refinance condo decisions that cut costs and improve cash flow

Why owners consider a refinance

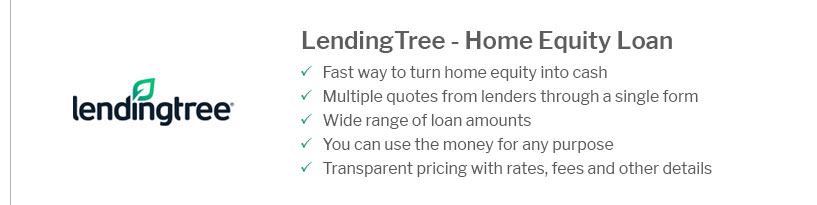

Refinancing a condo can lower your rate, shorten the term, remove PMI, or unlock equity for upgrades. Lenders review you and the building: HOA finances, insurance, owner-occupancy, reserves, and any litigation. Understanding these hurdles helps you time the application and compare offers with confidence.

How to prepare

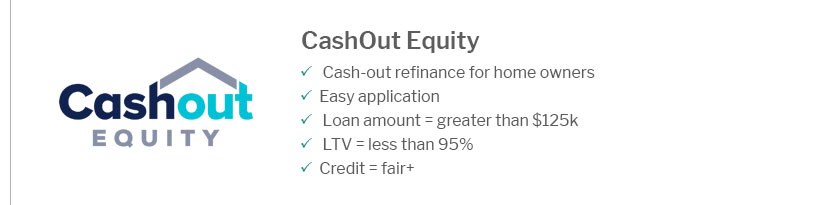

Before you apply, assemble documents and verify eligibility. Aim for solid credit, steady income, and a conservative loan-to-value. Ask the HOA for a condo questionnaire and master insurance evidence. If special assessments exist, be ready to explain purpose and payment plans, and show that reserves and coverage are adequate.

- Calculate savings and break-even on costs.

- Confirm warrantability and occupancy ratios.

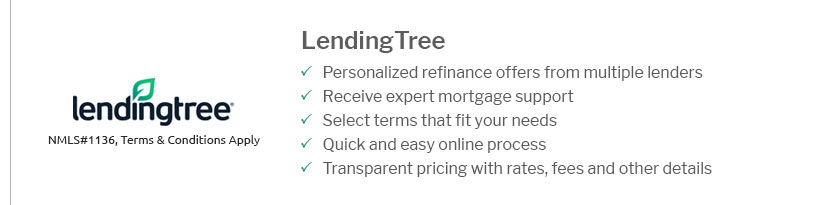

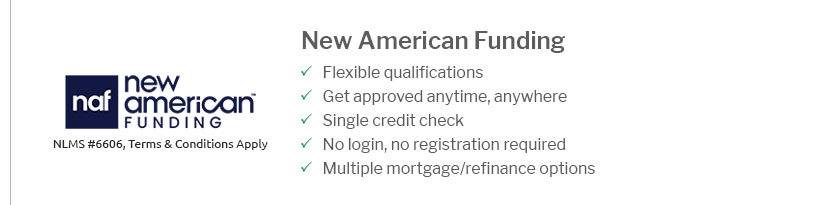

- Shop multiple lenders; compare APR and points.

- Choose term and lock; consider cash-in to 80% LTV.

- Close, fund, and set up escrow if required.

A clear plan, transparent docs, and realistic closing-cost math make the process smoother. When the savings align with your goals and risk tolerance, moving forward can be a confident, well-reasoned choice that strengthens long-term cash flow.